The Greater Vancouver Estate Market has been shifting over the last couple of months.

Traffic at open houses and the number of showings, for many properties, has dropped.

The total number of offers have declined significantly from the recent feverish levels, when there was a lineup of buyers at almost every property, submitting conditionless offers with prices well above the most recent market values.

Many listings are receiving just a single offer now and that offer has subjects(conditions). Buyers are being able to get offers with conditions accepted since many are no longer competing. There has been a substantial rise in the number of accepted offers that have subjects.

We’ve been seeing more and more listings start to advertise that offers will be reviewed on a first-come first-serve basis.

There are still listings coming up that are using the offers to be reviewed on a certain date strategy. Some of those listings are doing it based on the hope that the market hasn't shifted, some are doing it because they are listing it well below market value and as a result will receive more offers, while the remaining are doing it because they are still experiencing a strong level of demand.

Here is what the Chairman of the Real Estate Board of Greater Vancouver, Daniel John, recently said about the market:

“So far this spring, we’ve seen home sales ease down from the record-breaking pace of last year. While a small sample size, the return to a more traditional pace of home sales that we’ve experienced over the last two months provides hopeful home buyers more time to make decisions…”1

The President of the Fraser Valley Board, Sandra Benz, provided a similar insight:

“We would typically see a flurry of activity around this time of the year, however that’s not been the case so far. While it’s still too early to say whether this trend will endure, the slowing of sales combined with an increase in active listings is helping to restore a semblance of balance to the market, which is encouraging for homebuyers.”2

What’s led to the shift?

This is a tough one to quantify but in my opinion it's most likely a combination of; many buyers being priced out due to the significant rise in pricing, a good portion of the precovid pent up demand being satisfied, buyer’s fatigue/perception/sentiment of the market, higher inventory*(in some areas), and higher interest rates leading to investors leaving the market.

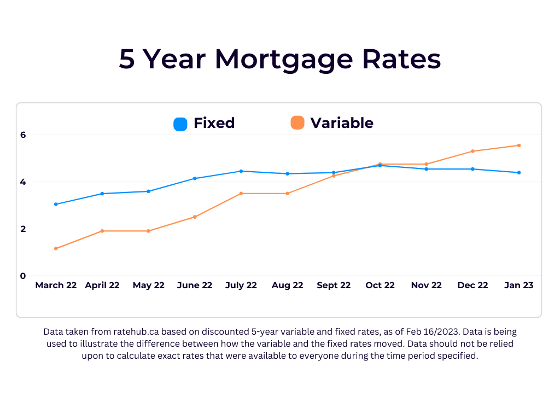

The reason why I link the higher interest rates to only investors leaving the market is because even though the 5 year fixed rates have risen significantly, and the variable rates are also on the rise, the mortgage amount that buyers can qualify for has not really changed significantly.

This is due to the stress test rules which state that the mortgage amount that a buyer can qualify for will be based on either the benchmark rate, which is 5.25%, or the rate offered by their lender plus 2%3, whichever is higher.

Buyer’s have been qualifying under 5.25% since June of 2021 and that hasn't really changed over the last few months during the shift. Even though the five year fixed rates for the 5 big banks of Canada are currently ranging between 4.29 to 4.42%4, the variable rates are still under 3%4, allowing buyers to still qualify using 5.25%.

Although investors can also qualify for the same amount as they had prior to the rise in rates, they are much more focused on the rates than they are about the mortgage amount. Their decision to buy is based purely on cost benefit whereas the decisions of buyers who are looking for a place to live is based on lifestyle and life stage changes.

In a country where about one-third of all residential properties are owned as investments (based on data released by the Canadian Housing Statistics Program of Statistics Canada)5 the entrance and exit of investors from the market can have a strong impact.

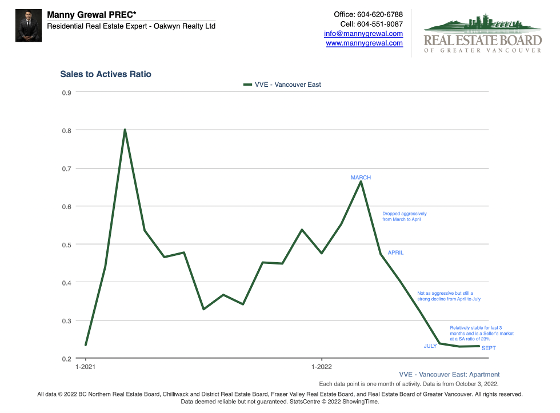

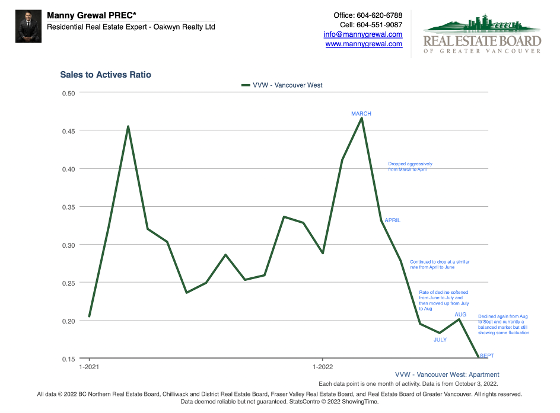

Has the market shifted equally for all areas and property types?

One of the questions that I always get asked is, “Hey Manny what's the market like?” My answer is always the same, “It depends on property type and location.”

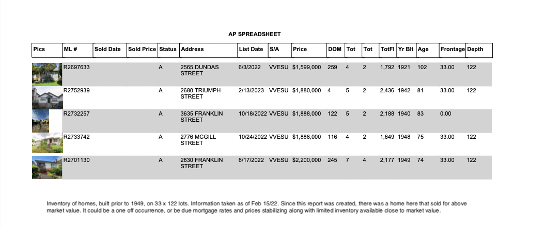

The Greater Vancouver Real Estate Market is essentially a collection of many different micro-markets, depending on property type and location. At any given time there can be differences in demand, pricing, and activity between these micro markets.

For example, not only can there be differences between the cities of Vancouver and New Westminster but there can also be differences between the neighbourhoods within Vancouver.

The same holds true for this current shift.

Although sales and number of offers are down overall, not all areas and properties are experiencing the same level of decline.

Generally speaking the condo and townhome markets are more active than the detached home markets. But within the condo and townhome markets there are areas that are also seeing a decline. And while the detached home markets have seen more of a decline than the condo and townhome markets there are still areas where activity remains strong.

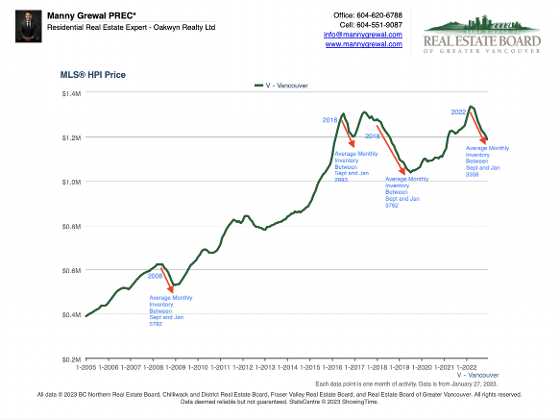

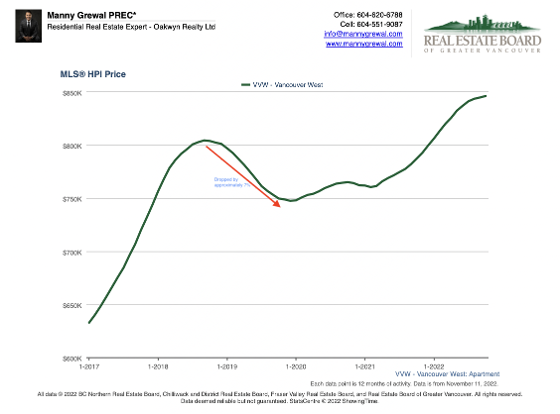

What's going on with prices?

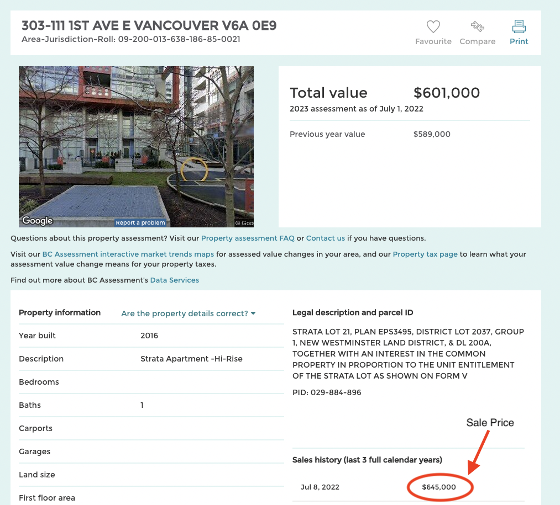

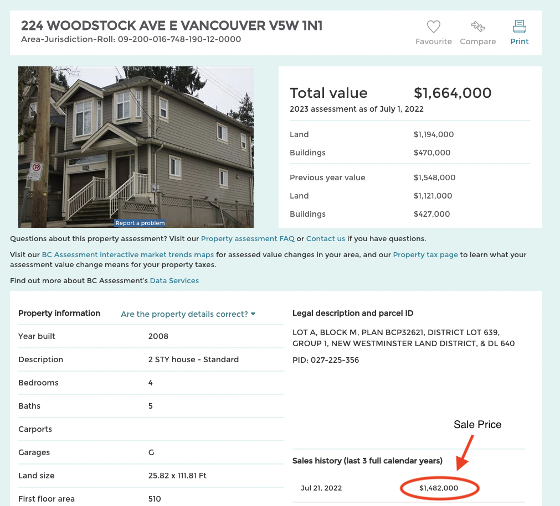

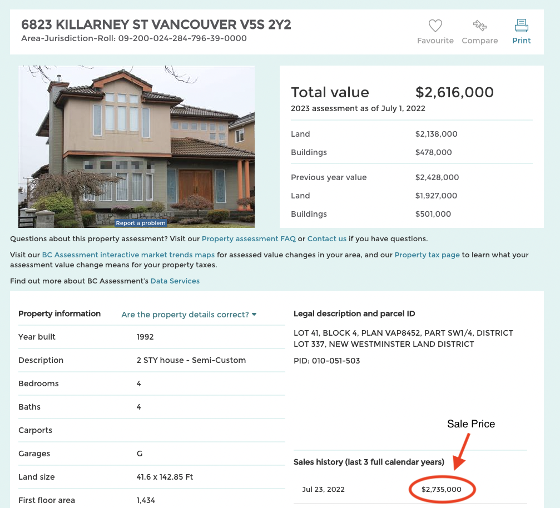

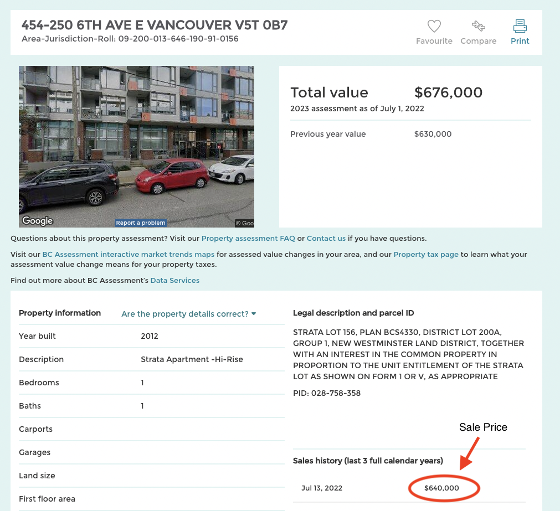

The strong upward pressure on pricing over the last couple of years started to subside a couple of months ago and based on the majority of recent sales, the prices are still stable for many markets.

However, there have also been a number of recent sales that sold for below the most recent market values.

Some of these lower priced sales were considerably lower than recent market values while others were somewhat lower. There isn't a large number of these types of sales yet, but prices have definitely come down for some property types and areas and there is another key observation worth noting that may have a further effect.

That observation is - some of the active listings on the market. There are some properties that are starting to sit on the market at prices that are both at, and below, the recent market values.

Is a correction on the horizon?

If you’ve been living in the Greater Vancouver area over the last 15 to 20 years, you’ve probably seen this question as a popular headline from time to time.

Although the long term pricing trend for the Greater Vancouver Real Estate Market has been upward over that time, the market has also been through a few, short term, downward cycles.

Is the market beginning to move through one of those downward cycles now? Will the price decrease spread across all the micro markets? Will prices decline at a higher rate?

Here are some forecasts that have been cycling through the news:

Royal Bank of Canada is predicting the aggregate benchmark price will decline 2.2% nationwide in 2023, with the downward price pressure to be more intense in Vancouver at 3.8%.6

Oxford economics are predicting a much more aggressive decline of 24%.7 (this one seems too over the top and would require either a massive surplus of inventory, a major rise in interest rates, or a combination of the two)

Instead of relying on forecasts, which have been incorrect in the past, here are few things that I will be monitoring that can influence cycles and pricing:

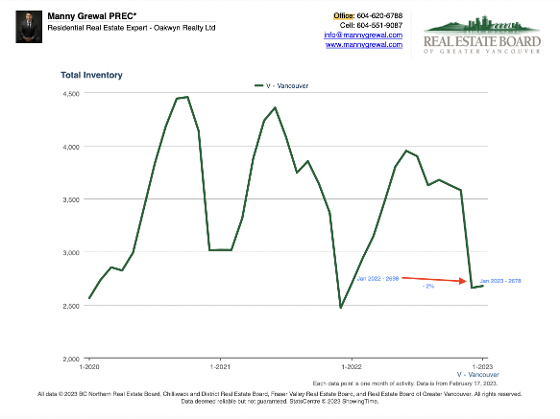

Inventory

Inventory has moved up in some areas but remains low in others, Most of the inventory is also overpriced. But as I mentioned earlier there are properties that are starting to sit on the market at prices that are at, and below, the recent market values. If that number continues to rise then it could contribute to downward pressure on pricing.

Interest Rates - Especially the Variable

As I mentioned earlier, so far buyers have not had the amount of mortgage they can qualify for reduced as long as they choose to go with the variable rate.

But that variable rate will continue to rise in response to the Bank of Canada raising its policy rate. Variable-rates offered by banks are typically expressed as “prime plus or minus” a percentage.When the Bank of Canada increases or slashes its overnight rate, prime rates typically adjust by a similar amount.8

The Bank of Canada has already stated that they will continue to forcefully raise the rate, if needed, to battle inflation.9 If, as a result, the variable rate moves to 4% or above, then there will be a notable decrease in the mortgage amount that a buyer can qualify for, leading to reduced purchasing power which could contribute to downward pressure on pricing.

Buyers Sentiment/Perception

Unlike inventory and rates, sentiment is hard to quantify but it can be gauged by those working in the frontline, namely real estate agents and mortgage brokers.

Ever heard of the term perception is reality?

I have seen buyer perception influence decisions in the past. In 2019 the market had hit the bottom of its downward cycle. Prices had dropped by a percentage that was equal to the percentage drop in the mortgage amount that buyers were able to qualify for, due to the stress test. Despite this, the majority of buyers did not enter the market because they perceived that the market may drop further.

If buyers perceive that we are in a downward cycle, and start to believe the forecasts mentioned, many of them may put their buying plans on hold. This would reduce the number of active buyers in the market, which could contribute to downward pressure on pricing.

Should you sell now? Should you buy now? Should you wait?

The Greater Vancouver Real Estate Market is a collection of micro markets(depending on property type and location), each with its own level of supply, demand, activity, and price changes.

Which is why the answer to these questions depends on the micro markets in which someone is considering buying and/or selling.

For those that would prefer to maximize their sale price in the short term, selling now should be considered since the majority of the overall market has stabilized while some micro markets have come down in price from their peak.

For those looking to buy in areas where inventory is rising and prices have come down from their peak, it may make sense to wait and see if prices come down further.

For those that are looking to buy in areas where supply is historically low, it may be better to move forward now because the opportunity to buy without having to compete, may be more advantageous than waiting for a possible decline in pricing.

For those that are looking to sell and buy, now could be a good time to make the move because even though the buying frenzy has subsided, thereby reducing the number of offers and over market sale prices, sellers are still getting good prices for their homes and once they sell and become buyers, they no longer have to deal with the stresses of being involved in multiple offers in many areas.

Please note though, that the Greater Vanocuver Real Estate Market is also very dynamic, activity and sentiment can change quickly.

Although the market has been shifting and some signs point to a downward cycle, inflation may subside or decline and as a result the interest rates may no longer rise or they may decline. Also, many sellers may remove their listings from the market if they feel that prices are going to come down and inventory may decline. Both of these changes would reduce downward pressure on pricing.

This is why the most important piece of advice I can provide, and stress, is that you should not rely on general stats, general consensus, and headlines when making a decision to buy, sell, or wait.

You should watch the micro markets that you are living in along with the ones that you are interested in moving to. By monitoring the most relevant markets you can put yourself in a position to move forward when you see shifts in the market that are either favourable to you or to avoid shifts in the market that may not be favourable.

Be market wise

Monitor what matters

Make informed decisions

If you have any questions about specific markets or if you would like to be up to date with and monitor specific markets, please call, text, or email me. I promise to provide an informative, pressure free conversation.

Please click here for a free consultation.

1. Real Estate Board of Greater Vancouver

https://www.rebgv.org/market-watch/monthly-market-report/april-2022.html

2. Fraser Valley Real Estate Board

http://www.fvreb.bc.ca/statistics/fvreb-posts-record-volume-of-new-listings-in-february-2-2/

3. Bank of Montreal

https://www.bmo.com/main/personal/mortgages/new-mortgage-rules-stress-test/

4. Rate Hub

https://www.ratehub.ca/best-mortgage-rates

5. Statistics Canada

https://www150.statcan.gc.ca/n1/daily-quotidien/220412/dq220412a-eng.html

6. CTV News

https://bc.ctvnews.ca/b-c-homes-prices-forecast-to-dip-3-8-next-year-following-interest-rate-hikes-1.5872989

7. Daily Hive

https://dailyhive.com/vancouver/canada-home-prices-forecast

8. Money Sense

https://www.moneysense.ca/save/financial-planning/financial-literacy-financial-planning/bank-of-canada-interest-rate/

9. Bank of Canada

https://www.bankofcanada.ca/2022/04/opening-statement-270422/

Subscribe with RSS Reader

Subscribe with RSS Reader